- MVP Templates

- Posts

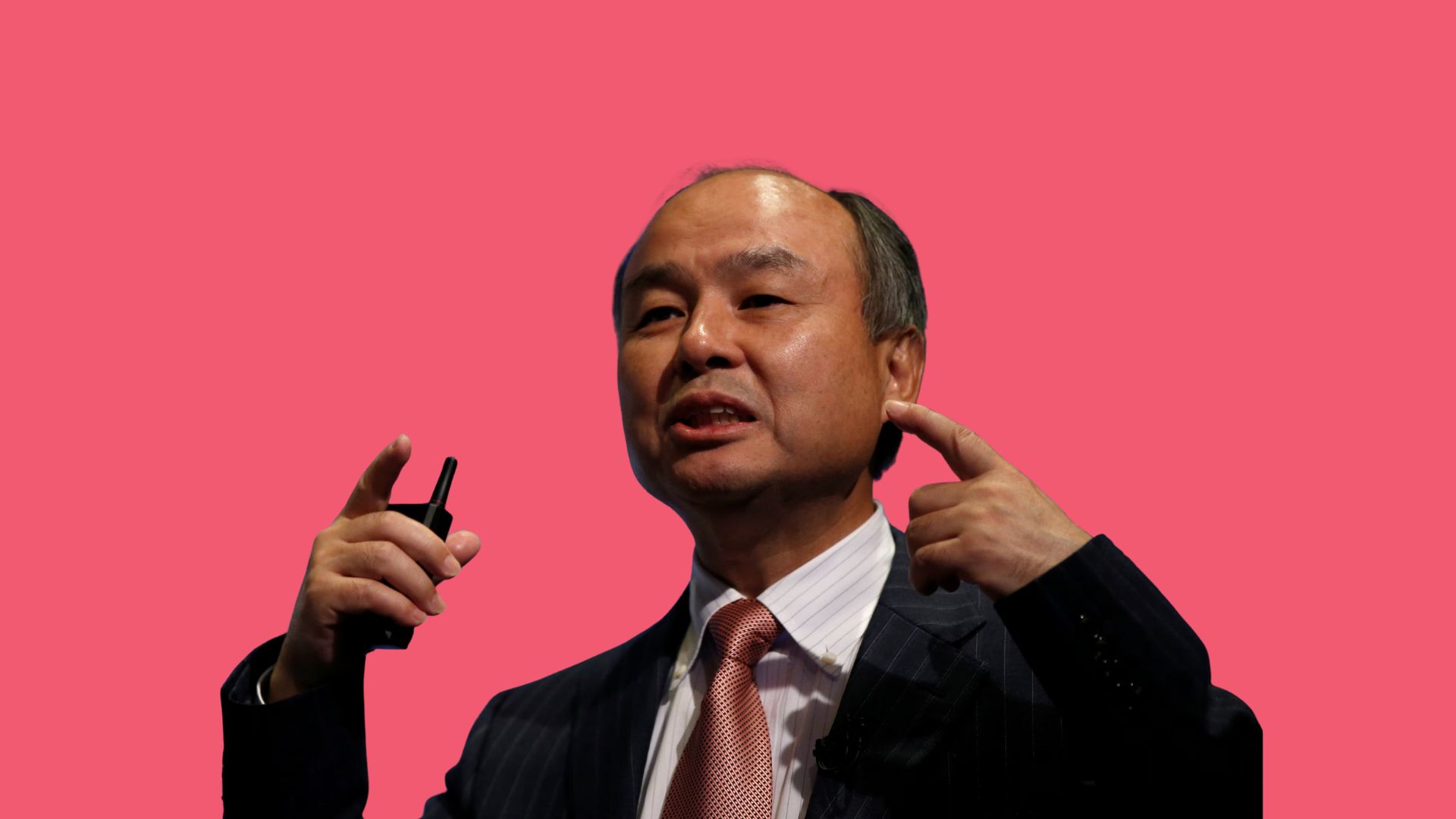

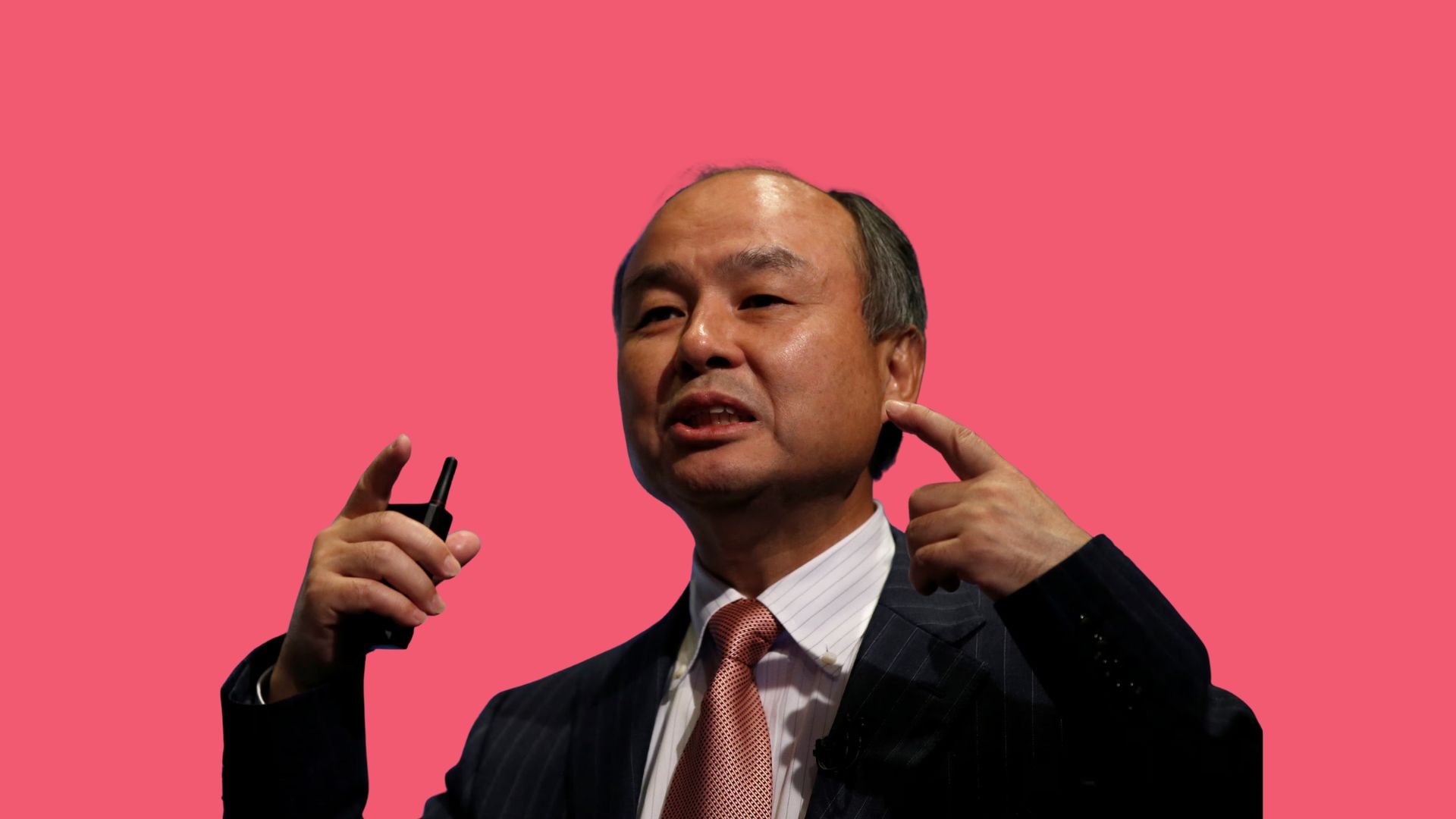

- The "300-Year Vision" Strategy That Built SoftBank's $100B Investment Empire

The "300-Year Vision" Strategy That Built SoftBank's $100B Investment Empire

Masayoshi Son's 300-year strategy that broke every VC rule

Busy Isn’t a Badge. It’s a Bottleneck..

Every minute you spend on low-value work costs you opportunities you can’t get back. That is why BELAY exists: to help leaders like you get back to what matters.

Our Delegation Guide + Worksheet gives you a simple system to:

✓ Identify what to delegate

✓ Prioritize what’s costing you most

✓ Hand it off strategically

And when you’re ready, BELAY provides top-tier remote staffing solutions — U.S.-based, highly vetted, and personally matched — to help you put those hours back where they belong: fueling strategy, leadership, and growth.

Real freedom starts with a right partner.

📍 Tokyo, Japan

In 2016, Masayoshi Son was facing a problem that would make most investors dismiss him as insane: he wanted to raise a $100 billion venture capital fund at a time when the largest fund in history was $30 billion.

Worse, he wanted to justify it using a 300-year business plan that included predictions about telepathy, cloning, and humanoid robots.

While VCs and institutional investors thought Son had lost his mind, he did something radical—he decided to lean into the madness.

Instead of hiding his long-term vision, Son made it the entire investment thesis. He told Saudi Arabia's Public Investment Fund that the "singularity" (AI becoming smarter than humans) would arrive within 30 years, and SoftBank needed to position portfolio companies for that inevitable future.

That positioning helped him raise $100 billion from Saudi Arabia ($45B), SoftBank ($28B), UAE Mubadala ($15B), and Apple ($1B)—the largest tech fund ever created.

Within the first year, Vision Fund had already committed $65 billion to Uber, WeWork, Slack, and GM Cruise, proving that impossibly long time horizons could convince patient capital to think bigger.

The Play: Impossible Timescales as Investor Persuasion Strategy

While traditional VCs pitched 5-7 year exits and quarterly returns, Son took the opposite approach.

He used ultralong-term thinking (300 years) as the framework for investors to accept massive capital deployment today, reframing the investment thesis from "quick exits" to "infrastructure for inevitable futures."

Key Strategic Moves:

300-Year Organizational Design: Presented SoftBank not as a fund seeking returns but as a "strategic synergy group" designed to compound for centuries by evolving with technology shifts.

"Singularity Betting" Framework: Used AI timeline predictions as validation for $100M+ checks into companies solving problems for a future where AI dominates all industries.

Patient Capital Recruitment: Targeted sovereign wealth funds (Saudi Arabia, UAE) willing to accept 10-20 year holding periods in exchange for portfolio upside in AI-driven transformation.

The Results:

🚀 $100B raised in 2017 from global institutional investors by presenting 300-year business model

🚀 $65B deployed in first year to mega-rounds (Uber $9.3B, WeWork $8.5B, Slack $1.4B) proving scale of vision

🚀 88 portfolio companies invested across AI, robotics, autonomous vehicles, and biotech—creating ecosystem bets on singular future

The Genius Behind Son's "Impossible Vision" Fundraising Strategy

1. Grand Vision as Due Diligence Substitute

Son famously said he had "an ability to see the future and bet on ambitious entrepreneurs."

Rather than traditional financial analysis, his 300-year vision became the investment thesis itself—investors bought into the narrative that Son could spot companies solving problems for futures others couldn't yet imagine.

2. Sovereign Wealth Funds as Patient Capital Source

Traditional VCs wanted exits in 7-10 years. Son targeted Saudi Arabia and UAE sovereign wealth funds that had 70-year+ investment horizons.

This perfectly aligned with his 300-year thesis, allowing him to raise capital that didn't require traditional return timelines.

3. Reframing Insanity as Clarity

Son's 300-year vision seemed delusional, but he weaponized that perception.

By publicly claiming he was betting on singularity and thinking centuries ahead, Son positioned his fund as the only one taking seriously the inevitable AI revolution.

Investors who dismissed him as crazy couldn't ignore that his framework predicted the future better than quarterly-focused competitors.

💡 How to SoftBank’s Fundraising Playbook

1. Use Ultralong Timescales to Justify Today's Bold Bets

Frame your company as a leader based on 20, 30, or 50+ year timelines rather than 5-10 year exits

Use impossible futures (AI singularity, space colonization, biological transformation) as justification for massive capital deployment

Show investors how long-term thinking unlocks opportunities short-term competitors can't see

2. Position Founder Vision as Competitive Moat

Frame your personal ability to see the future as the company’s primary asset

Use prediction accuracy to justify capital allocation

Build legendary status around your vision so LPs feel they're investing in your foresight, not financial engineering

3. Target Patient Capital with Aligned Time Horizons

Identify institutional investors (sovereign wealth funds, endowments, foundations, family offices, etc.) with long investing timelines

Present your vision aligned with their time horizons rather than trying to fit into traditional VC frameworks

Show how patient capital enables compound growth that aggressive return-seeking capital cannot achieve

Startups Currently Raising from Around the World

Are you ready to be featured on this list?

Heidi (Australia): AI-powered medical scribe platform that automates clinical documentation by transcribing patient consultations in 110+ languages and generating clinical notes, referral letters, and billing codes, helping healthcare professionals reclaim 8+ million hours annually while reducing documentation-related stress by 58%.

🔗 heidihealth.com

📄 Funding Announcement

💰 Raising: $65M (Series B) | Committed: Fully raised (October 2025; led by Point72 Private Investments with participation from Blackbird, Headline, and Latitude at $465M valuation, bringing total funding to $100M)

Strella (USA): AI-powered customer research platform that conducts AI-moderated interviews with dynamic follow-up questions and real-time synthesis, enabling companies like Amazon, Chobani, and Duolingo to gather qualitative insights 10x faster than traditional methods at half the cost.

🔗 strella.io

📄 Funding Announcement

💰 Raising: $14M (Series A) | Committed: Fully raised (October 2025; led by General Catalyst with participation from Decibel Partners, bringing the company's mission to democratize customer research)

Crusoe (USA): Vertically integrated AI infrastructure company building purpose-built data centers powered by renewable energy sources, with a portfolio including a 1.2 GW campus in Abilene, Texas and a 1.8 GW facility in Wyoming, capable of supporting 946,000 GPUs for AI training and inference workloads.

🔗 crusoe.ai

📄 Funding Announcement

💰 Raising: $1.38B (Series E) | Committed: Fully raised (October 2025; co-led by Valor Equity Partners and Mubadala Capital with participation from Nvidia, Fidelity, and Founders Fund at $10B valuation, bringing total funding to $3.9B)

Takeaway:

Masayoshi Son didn't just raise capital—he revolutionized how visionary founders persuade institutional investors by proving that impossible 300-year timescales could justify today's most aggressive bets.

By positioning his Vision Fund around AI singularity and creating portfolio synergies around that singular future, Son convinced sovereign wealth funds to commit $100 billion to a thesis that seemed insane by traditional venture standards.

His success proves that sometimes the best way to raise massive capital isn't to be conservative or predictable—it's to embrace the audacity of your vision and find investors aligned with centuries-long time horizons.

For founders, the lesson is clear: Stop pitching quarterly returns and 7-year exits. Find patient capital aligned with your long-term vision, then deploy at scales your competitors can't imagine because their investors won't allow it.

Want to raise massive capital for impossible bets? Stop talking to VCs seeking quick exits. Find sovereign wealth funds and institutional investors who measure success in decades, not quarters.

Build Aggressively.

— Forbes 30 under 30 | Top 5% Inc. 5,000 Entrepreneur | $100M+ in exits

📩 PS: Was this helpful? Hit reply to let us know & share your startup story—we’d love to hear it!

📩 PSS: Do you want help raising money and scaling you business? Click here set up a meeting!

What'd you think of this post? |